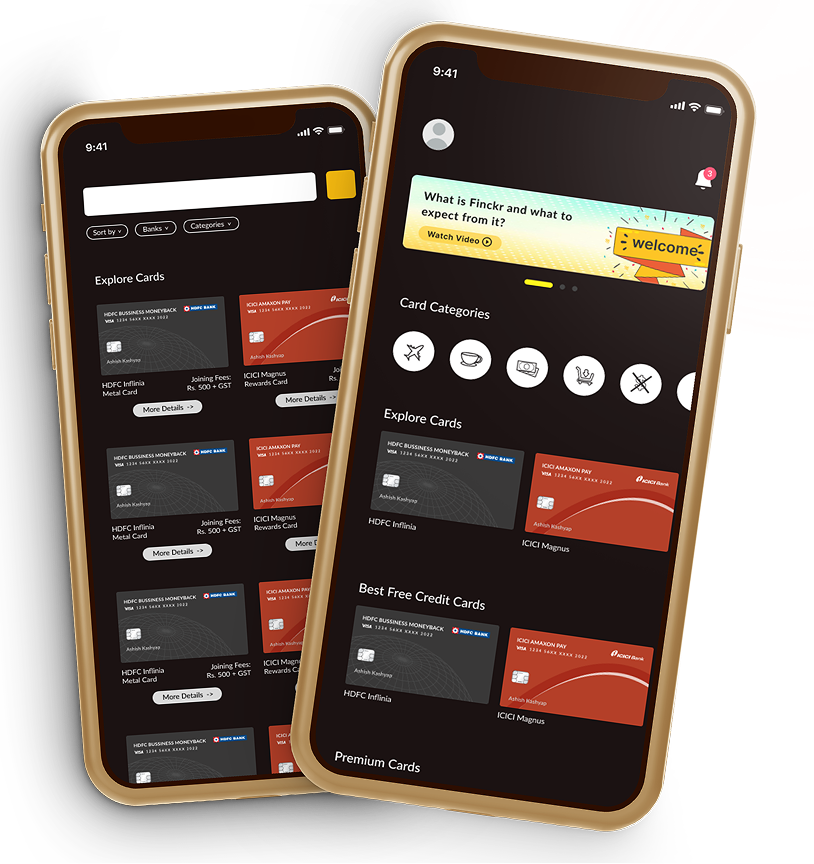

Find and apply for the best credit card

Discover, Compare, andUnlock Credit Cards.

Find and apply for the best credit card tailored to your needs—simple, fast, and hassle-free.

Top Credit Card Categories

Explore India's top credit card categories and kickstart your credit journey. Find the best-rated cards, including lifetime free options, and choose the perfect one for you.

Best Free Credit Cards

Discover the best free credit cards in India and start your credit journey with top-rated, lifetime free options.

IDFC FIRST Millennia Credit Card

Joining Fee - Nil

Movie & Dining : 25% Discount Up to 100 on District App. 20% Discount on Popular Restaurants

Rewards Rate : 3X Reward Points Till Spends of 20,000. 10X Reward Points After Incremental Spends of 20,000

Travel : Get four complimentary railway lounge accesses and four roadside assistance services a year, each worth Rs. 1399.

Insurance Benefits : Personal Accidental Cover worth Rs. 2 Lakhs on all active cards. Lost Card Liability Cover of Rs 25,000.

Fibe Axis Bank RuPay Credit Card

Joining Fee - Nil

Movie & Dining : 3% Cashback on Entertainment Spends & 15% Off With the Axis Bank Dining Delights Program.

Rewards Rate : 3% Cashback on Entertainment, Food Delivery & Commute

Reward Redemption : Direct Cashback

Travel : Domestic Lounge Access Available

Domestic Lounge Access : 1 Complimentary Domestic Lounge Access Every Quarter

HDFC Platinum Times Credit Card

Joining Fee - NIL

Movie & Dining : 50% discount (max Rs. 600 per transaction) on Movie Tickets booked on BookMyShow15% discount up to maximum of Rs. 1500 at restaurants through PayEazy on Eazydiner

Rewards Rate : 3 Reward Points on every spend of 150. 10 reward points on every weekday dining spent of 150.

Reward Redemption : You can redeem rewards by logging into your HDFC Bank net banking account and clicking on the reward redemption link.

Kotak Urbane Gold Credit Card

Joining Fee - Nil

Rewards Rate : 3x Reward Points per Rs. 100 you spend on all retail transactions

Reward Redemption : Redeem the earned points for various categories like Movie Tickets, Mobile Recharge, etc. Rewards Points can used to pay your shopping bills through PayByPoints Program

Insurance Benefits : Insurance cover for a lost or stolen card

RBL Bank Insignia Preferred Banking World Card

Joining Fee - Nil for Insignia Preferred Banking Customer. 7,000 + GST for Others

Movie & Dining : Flat Rs. 500 off on movie tickets on BookMyShow, Priority reservations, and personalized hospitality from the chef with an exclusive dining program.

Rewards Rate : 5 Reward Points per Rs. 100 spent on domestic transactions, 10 Reward Points per Rs. 100 spent on international transactions.

Reward Redemption : Reward Points redeemable for e-vouchers, mobile recharges, flight bookings, etc. 1 RP = Re 0.25 (approx)

Travel : You get complimentary domestic as well as international lounge access.

Domestic Lounge Access : 2 Complimentary Domestic Lounge Access Per Quarter

International Lounge Access : 6 complimentary international lounge access every year via Priority Pass

Golf : 4 complimentary rounds of green fees every year, 12 complimentary golf lessons every year.

IndusInd Legend Credit Card

Joining Fee - Nil

Movie & Dining : BOGO on 1 movie ticket every month up to Rs. 200.

Rewards Rate : 1 Reward Point per Rs. 100 spends on weekdays and 2 Reward Points for every Rs. 100 you spend on weekends.

Reward Redemption : 1 RP = 0.50 for Redemption Against Cash Credit

Insurance Benefits : Get a Complimentary Air Accidental cover of Rs 25 Lakhs. Complimentary Lost baggage Insurance of Rs 1 lakh and several other travel insurance covers.

BOBCARD Easy Credit Card

Joining Fee - Nil

Rewards Rate : 5X reward points on every Rs. 100 spent on movies, groceries, and departmental stores. 1 reward point on every Rs. 100 spent on other categories.

Reward Redemption : Accumulated reward points can be redeemed against cashback and other exciting options. 1 reward point is equivalent to 0.20

Standard Chartered Rewards Credit Card

Joining Fee - Nil

Rewards Rate : 4 Reward Points on every retail spend of Rs. 150, 1 RP on every Rs. 150 spent on government payments and insurance.

Reward Redemption : 1 RP = Re 0.25 for redemption against the Rewards catalog and 1 RP = Re. 0.20 for redemption against the card's statement balance.

Travel : Complimentary domestic lounge access every quarter.

Domestic Lounge Access : 1 free domestic lounge access every quarter, i.e. 4 per year.

Best Premium Credit Cards

Discover the best premium credit cards in India and elevate your spending experience with top-rated benefits and exclusive privileges.

IDFC First Private Credit Card

Joining Fee - Rs. 50,000 + GST

Movie & Dining : Get up to Rs. 750 discount on movie/non-movie bookings via BookMyShow

Rewards Rate : 3 Reward Points on every Rs. 100 spent offline and 6 RPs on every Rs. 100 spent online

Reward Redemption : 1 Reward Point = Re. 0.25 for redemption against various gift vouchers

Travel : Unlimited Railway Lounge Access Across India

Domestic Lounge Access : Unlimited Domestic Lounge Access (Primary and Add-On Cardholders)

International Lounge Access : Unlimited International Lounge Access (Primary and Add-On Cardholders)

Golf : Free Unlimited Golf Rounds/Lessons Every Month

Insurance Benefits : Travel Insurance and Air Accident Cover

Axis Bank Miles & More Credit Card

Joining Fee - Rs. 10,000 + GST for Miles & More Select Credit Card & Rs. 3,000 + GST for Miles & More World Credit Card

Movie & Dining : Minimum 15% discount on dining bills at partner restaurants with Axis Bank Dining Delights Program

Rewards Rate : 6 award miles per Rs. 200 spent with Axis Bank Miles & More Select Credit Card and 4 award miles per Rs. 200 spent with Axis Bank Miles & More World Credit Card

Reward Redemption : Miles are redeemable for flight bookings, hotel reservations, car rentals, shopping or for donations

Travel : Complimentary domestic and international airport lounge access

Domestic Lounge Access : Axis Bank Miles & More Select Credit Card -8 complimentary domestic airport lounge; Axis Bank Miles & More World Credit Card- 4 complimentary domestic airport lounge access per quarter

International Lounge Access : 4 complimentary airport lounge access per year with Axis Bank Miles & More Select Credit Card and 2 complimentary airport lounge access per year with Axis Bank Miles & More World Credit Card with Priority Pass membership

Insurance Benefits : Complimentary personal air accident insurance, check-in baggage and travel documents loss/delay cover and Credit Shield cover with both the variants of the card

AU Zenith+ Credit Card

Joining Fee - Rs. 4999 + GST

Movie & Dining : 16 complimentary Buy One Get One movie tickets per annum, max 4 per quarter

Rewards Rate : 2 RPs per Rs. 200 spent on dining, international, and travel spends. 1 RP per Rs. 100 on other spends

Travel : Complimentary Taj Epicure Membership on spending Rs. 12 Lakhs in the year.

Domestic Lounge Access : 4 Complimentary Lounge Access Every Quarter (16 Each Year)

International Lounge Access : 16 complimentary international lounge access

Golf : 8 complimentary golf lessons per annum, max 2 per quarter

Insurance Benefits : Complimentary device protection plan

HDFC Bank INFINIA Metal Credit Card

Joining Fee - Rs. 12,500 + GST

Movie & Dining : 1 + 1 Complimentary Buffet at ITC Hotels and Up to 750 With Swiggy Dineout

Rewards Rate : 5 Reward Points on every retail spend of Rs. 150, reward rate of up to 3.3%

Reward Redemption : RPs can be redeemed for flight and hotel bookings via SmartBuy (1 RP = Re. 1), Airmiles through net banking (1 RP = 1 Airmile), products and vouchers via net banking or SmartBuy (1 RP = Rs. 0.50), Apple and Tanishq vouchers (1 RP = Re. 1) cashback (1 RP = Rs. 0.30)

Travel : Complimentary Priority Pass Membership

Domestic Lounge Access : Unlimited Free Domestic Airport Lounge Access

International Lounge Access : Unlimited Complimentary International Lounge Access for Primary and Add-On Cardholders Across the Globe with a Priority Pass

Golf : Unlimited complimentary golf games at leading golf courses across India and abroad. Unlimited golf coaching at multiple golf courses across India

Insurance Benefits : Insurance cover worth Rs. 3 crores against accidental air death, a cover worth Rs. 50 lakh against medical emergencies during international air travel, and credit shield cover worth Rs. 9 lakh

HSBC Taj Credit Card

Joining Fee - Rs. 1,10,000 + GST

Movie & Dining : BOGO on Movies and Discounts at PVR, Swiggy, Zomato, and Starbucks.

Rewards Rate : 5 RPs/100 Spent at Taj, SeleQtions, Gateway, Vivanta, Ginger Hotels and am Stays & Trails Bungalows. 1.5 RPs/100 on All Other Eligible Purchases

Reward Redemption : Use RPs at Participating Indian and Global Hotels. 1.5 RPs = 1

Travel : 4 Chauffeur-Driven Limousine Transfers in a Year and 15% Discount at Adani One

Domestic Lounge Access : Unlimited Airport Lounge Access

International Lounge Access : Global Unlimited Airport Lounge Access

Kotak White Reserve Credit Card

Joining Fee - Rs. 12,500 + GST

Movie & Dining : Get up to 20% off on dining bills at participating Marriot hotels across the Asia Pacific Region

Rewards Rate : White Pass Value will be earned for Reward Points on crossing a minimum spend of Rs. 3 Lakhs

Reward Redemption : The White Pass Value can be redeemed against various vouchers, flights, and hotels, etc available at kotakbankwhite. The White Pass Value can also be redeemed for cash.

Travel : Complimentary access to lounges at 1000+ airports around the world

Domestic Lounge Access : Unlimited complimentary lounge access at domestic airports across India

International Lounge Access : Unlimited complimentary lounge access at airports across the globe

Golf : 2 Golf Rounds each month at selected golf courses around the world

RBL Bank Icon Credit Card

Joining Fee - Rs. 5,000 + GST

Movie & Dining : BOGO on Movie Ticket Bookings With BMS

Rewards Rate : 2 RPs per Rs. 100 spent on retail purchases and 20 RPs per Rs. 100 spent on international transactions and dining on weekends.

Reward Redemption : You can easily redeem your reward points against hotels and flights booking. You can also utilize your reward points for purchasing vouchers, gifts, recharge, shopping, lifestyle products, etc. 1 RP = Re. 0.25.

Travel : Complimentary Priority Pass Membership

Domestic Lounge Access : Get 2 complimentary domestic lounge access per quarter.

Golf : 4 complimentary golf games & 12 complimentary golf lessons each year.

IndusInd Bank Pioneer Heritage Credit Card

Joining Fee - Rs. 100,000 + GST

Movie & Dining : Up to 3 complimentary tickets every month on Pioneer Heritage credit card and 4 Complimentary tickets every calendar quarter on Pioneer Heritage Metal credit card. Also, you get 20% off on your non-movie bookings.

Rewards Rate : 2.5 Reward Points for Rs 100 spent on international transactions and 1 Reward Points for Rs 100 spent on domestic transactions.

Reward Redemption : 1 RP = Rs 1 redeemed against a host of redemption options such as the Indus Moments reward portal, AirMiles, and against statement cash

Travel : Complimentary Domestic and International lounge access, complimentary LoungeKey membership and get a complimentary third-night stay at Oberoi Hotels and Resorts.

Domestic Lounge Access : Unlimited (with Pioneer Heritage Metal credit card) and 2 per quarter (with Pioneer Heritage credit card)

International Lounge Access : Unlimited (with Pioneer Heritage Metal credit card) and 2 per quarter using LoungeKey membership (with Pioneer heritage Credit Card).

Golf : 12 complimentary rounds of green fees & 12 complimentary golf lessons every year. Also, you get 4 complimentary green fees rounds for guests.

Insurance Benefits : Complimentary air accident protection cover worth upto Rs 2.5 crore on this credit card

SBI Card Miles Elite

Joining Fee - Rs. 4999 + GST

Rewards Rate : 6 Travel Credits per Rs. 200 spent on Travel-related expenses

Reward Redemption : Air Miles/Hotel Points: 1 Travel Credit = 1 Air Mile/Hotel Point

Travel : Complimentary Priority Pass Membership for the first 2 years

Domestic Lounge Access : 8 complimentary visits per calendar year (maximum 2 per quarter)

International Lounge Access : 6 complimentary visits per calendar year

Fuel Surcharge : 1% Fuel Surcharge Waiver on transactions between ₹500 and ₹4,000 at any petrol pump across the country

American Express Platinum Charge Card

Joining Fee - Rs. 66,000 + GST

Movie & Dining : Complimentary EazyDiner Prime Membership, 50% Discount at Premium Restaurants, and 500 Off on the Second Movie Ticket Purchased with PVR INOX (Once Each Month)

Rewards Rate : 1 MR Point/40 Spent Domestically, 3X MR Points on International Spends, and 5X MR Points Via AmEx Reward Multiplier

Reward Redemption : Membership Rewards Points can be redeemed against dining, travel, and accessories on AmEx's Membership Rewards Redemption portal.

Travel : Accelerated Reward Points on International Spends

Domestic Lounge Access : Unlimited Free Airport Lounge Access

International Lounge Access : Access to Over 1,300 Airport Lounges Globally, Including American Express Lounges, Priority Pass Lounges, and Delta Lounges.

Golf : Complimentary Access to Premium Domestic and International Golf Courses

Insurance Benefits : Personal air accident coverage worth Rs. 5 crore, cover of Rs. 50,000 for loss of check-in Baggage/ passport/ document, overseas medical insurance of USD 50,000 for the first 7 days of the trip.

BOBCARD ETERNA Credit Card

Joining Fee - Rs. 2,499 + GST

Movie & Dining : 5X reward points on movie and dining spends, 250 plus culinary deals at MasterCard Priceless specials, Buy One Get One scheme on movie tickets booked through District app (max discount capped at 250/month)

Rewards Rate : 15 Reward Points /100 on online shopping, travel, movie, and dining spends (max cap of 5,000 points at this rate)

Reward Redemption : Reward points redeemable as cashback or against flight tickets, hotel reservations, shopping, etc at a rate of 1 RP = Re. 0.25.

Travel : Low Forex Markup Charge of 2%

Domestic Lounge Access : Unlimited Domestic Airport Lounge Access on Spends of 40,000 in the Previous Quarter

Insurance Benefits : Accidental death cover (worth 1 crore in case of air-accident and Rs. 10 lakh in all other cases)

Standard Chartered Ultimate Credit Card

Joining Fee - Rs. 5,000 + GST

Rewards Rate : 5 Reward Points on every retail purchase of Rs. 150

Reward Redemption : The earned Rewards are redeemable on the SC online portal under the Standard Chartered 360 rewards program. 1 Reward Point = Re. 1.

Travel : Complimentary Priority Pass membership with free domestic and international lounge access, and 5% cashback on all duty-free purchases at airports.

Domestic Lounge Access : 16 domestic lounge access per year (4 every quarter)

International Lounge Access : 1 complimentary lounge visits per month with the Priority Pass membership.

Golf : 1 complimentary golf game per month, and 1 free golf coaching session each month.

Insurance Benefits : Air accidental insurance cover worth Rs. 1 crore, and several travel insurance covers.

ICICI Bank Diamant Credit Card

Joining Fee - Rs. 1,25,000 + GST

Movie & Dining : Up to 4 complimentary movie tickets each month on BookMyShow, minimum 15% discount on dining bills at partner restaurants under Culinary Treats program, discount on dining at ITC and partner hotels with Club ITC Culinaire membership

Rewards Rate : 6 Reward Points per Rs. 100 on internationally and 3 Reward Points on domestic spends.

Reward Redemption : The ICICI Reward Points can be redeemed against cashback or gifts at a rate of 1 Reward Point = Rs. 0.25.

Travel : Taj Epicure Plus and InnerCircle Gold membership, unlimited complimentary domestic and international airport lounge access

Domestic Lounge Access : Unlimited complimentary domestic airport lounge access

International Lounge Access : Unlimited complimentary international airport lounge access

Golf : Unlimited complimentary rounds of golf at domestic and international Golf courses

Insurance Benefits : Credit shield cover worth Rs. 50,000 and many travel-related insurance benefits including a personal air accident cover worth Rs. 3 crore.

YES Bank RESERV Credit Card

Joining Fee - Rs. 2,499 + GST

Rewards Rate : 24 Reward Points for every Rs. 200 spent online. 12 Reward Points for every Rs. 200 spent on offline shopping and 6 RPs on select categories

Reward Redemption : Reward Points Can be Redeemed on the YesRewardz Portal Against Multiple Options

Domestic Lounge Access : 12 Domestic Lounge Visits Every Year (3 Per Quarter) on Spending 1 Lakh or More in the Previous Quarter

International Lounge Access : 6 Lounge Visits Outside India Each Year

Golf : 4 Complimentary Rounds of Golf With Green Fee Waived and 1 Complimentary Golf Lesson Per Year

Insurance Benefits : Insurance coverage is worth Rs. 3 crore if the cardholder's life is lost due to an air accident, and medical insurance is worth Rs. 50 lakh in case of emergency overseas hospitalization and a Credit Shield cover (up to Rs. 10 lakh) against outstanding card dues in the unfortunate event of the primary cardholder's death.

Credit Card Blogs & Offers

Keep up with the latest trends and offers from our experts. Read the articles to keep yourself updated!

The Difference Between A Credit Card And A Debit Card

Although debit and credit cards are sometimes used interchangeably, they have important distinctions that may impact your financial status. Despite having almost the same appearance, they have magnetic strips, EMV chips, expiration dates, and 16-digit card numbers. However, there are significant differences in how they work and what advantages they provide.

All about Credit Card

A credit card is a financial instrument that lets the user make purchases and pay for them later. Since it has a pre-loaded balance, the card issuer allows the user to settle the balance without incurring interest up to 50 days from the payment date.

What is CVV in a credit card?

A distinct three-digit CVV code is needed to complete each transaction you make with your credit or debit card. Have you ever considered how crucial the CVV number is? The acronym for Card Verification Value is CVV. In addition to being necessary for card transactions, it offers an additional layer of protection against fraud.

Download Finckr App

Effortlessly apply for India's top credit cards through a secure and user-friendly platform right at your fingertips.

Find the perfect card by comparing features, rewards, and benefits side by side & Get personalized card recommendations tailored to your spending habits.

Add your credit cards to stay updated on benefits, rewards, and exclusive offers. Never miss out on perks and updates tailored to your cards!